Master List 360 Investor / LP Database

INSTANT Download Investor / LP Database with 501,270+ Records & 191,118+ E-Mail Contacts & 161,721 Phone Contacts

Our Complete Master List Library 360 contains a truly comprehensive and diverse dataset of 300+ Discrete Excel Files:

• Investors (Angels, VCs, PEs)

• LPs (Family Offices / Institutional Investors)

• HNWIs & UHNWIs

• Funds (VC, PE, Mutual, Hedge)

• Founders / Startups

• Accelerators / Incubators / Venture Studios

Geography: Approximately 65% of our records are U.S. Based with 30% European Based and 5% LATAM, Asia, Africa.

Thoroughly examine our excel database samples before purchasing, which can be found here:Sample Data

What Makes Master List 360 Unique:

All-in-One Capital Intelligence StackMaster List 360 spans over 500,000+ investor, LP, and fund records across 300+ Excel files, ready for CRM upload. Key databases include:• Family Office Database

• Institutional Investor Database

• Real Estate Investor Database

• Venture Capital Database

• Angel & HNWI Investor Database

• Private Equity Database

• Fund of Funds Database

• Investment Banking Database

• Mutual Fund Database

• Startup Founder DatabaseGranular Data Structure

15–30 fields per contact record. Professional roles, investment preferences, AUM, geography, direct contact details (validated emails, phone numbers), and LinkedIn profiles for matching multiple channels of outreach with your ideal investor profile.Immediate Bulk Access Without Restrictions

Download entire datasets as Excel files upon purchase. No user limits, export caps, or subscription requirements. Full data ownership with no platform dependencies.Competitive Pricing

Cost per record typically 2–3x lower than platforms like PitchBook or Preqin. One-time purchase model with no recurring fees or hidden costs.Regular Updates & Enhancements

Datasets refreshed & supplemented by regular additions of new investors, emerging funds, and re-verified contacts. Ensures relevance to current market trends.Pre-Validated and CRM-Optimized

All contact data verified for accuracy and pre-formatted for direct CRM import. Eliminates manual cleanup.Over $100M Raised

Clients have raised over $100M+ in capital in aggregate, with faster deal velocity and deeper investor access than any subscription SaaS alternative.

July 2025 Updates

Key Data Infusions for July 2025:

Wealth Management Firm DatabaseThis database provides access to a diverse roster of wealth-management decision-makers and executives across the globe.Wealth Management Entity Types Include:• Dedicated Wealth Management Firms

• Family Offices

• Registered Investment Advisors (RIAs)

• Robo-Advisors

• Hybrid Wealth Management Firms

• Private Banks with Wealth Management Arms

• Boutique Wealth Managers

• Trust Companies

• Investment Firms...and other specialized wealth management platformsDatabase Contact Details Include:• 6,500+ Validated Emails

• 4,700+ Phone numbers

• 4,000+ Corporate and Professional LinkedIn profiles

• 74,160+ data points

• 6,700+ Decision Makers Across 6,000+ FirmsDecision-Maker Titles Include:• Managing Partners

• Chief Executive Officers (CEOs)

• Chief Financial Officers (CFOs)

• Chief Operating Officers (COOs)

• Presidents & Vice Presidents

• Principals

• Partners

• Wealth Advisors

• Portfolio Managers

• Chief Compliance Officers (CCOs)...and morePrivate Equity Tech-Centric DatabaseThis database is built to unearth decision-makers at the world’s most active technology-focused private equity firms.New Enhanced Data Points Include:• Investment Stage Preference (Seed, Series A/B, Growth Equity, Buyout)

• Check Size Range ($1M–$5M, $10M+, etc.)

• Ownership Requirements (Minority, Majority, Control)

• Board Seat Preference

• Target EBITDA / Revenue RangeDatabase Contact Details Include:• 7,000+ Unique Validated Emails (Up to 3 per contact)

• 2,500+ Phone Numbers (Up to 3 per contact)

• 100% LinkedIn Coverage (5,700+ Decision Maker Profiles)

• 119,926 cells of granular intelligence across 35+ fieldsExisting Firmographic Filters:• Investing Thesis

• Investing Sectors

• Portfolio Companies

• Preferred Investment RegionsInvestment Banking DatabaseComprehensive contact database containing the world’s most influential Investment Banking executives from 1,000+ firms managing $13.1T+ in assets.Data Coverage:• 4,000+ Validated Emails

• 2,900+ LinkedIn Profiles

• 2,500+ Phone numbers

• 77,736 data points across 30+ fieldsBroad Firmographic Filters:• Investment Bank Description / Investing Thesis

• Preferred Sectors

• Target Geography

• Deal Size Range

• Stage FocusDecision-Maker Titles Include:C-Suite Executives• Chief Executive Officers

• Chief Financial Officers

• Chief Operating Officers

• Chief Compliance Officers

• Chief Risk OfficersManaging & Executive Leadership• Managing / Executive Directors

• Board Members / Directors

• Presidents

• FoundersSector & Functional Heads• Heads of Investment Banking

• Heads of Capital Markets / Research

• Fund Managers

• Portfolio ManagersVice President & Mid-Tier Roles• Senior Vice Presidents

• Vice Presidents

• Associate Vice Presidents

• Assistant Vice Presidents...and moreRetirement Funds DatabaseConnects to 900+ executives from 500+ institutions with $3 trillion AUM across corporate, municipal, and nonprofit retirement plans.Database Contact Details Include:• 2,300+ Unique Emails (Up to 2 per contact)

• 1,000+ Unique Phone Numbers (Up to 2 per contact)

• 44,295 cells of intelligence across 30+ fieldsDecision-Maker Titles Include:• Chief Investment Officers

• Portfolio Managers

• Investment Directors

• Plan Sponsors

• Committee Members

• Heads of Asset Allocation

• Board of Trustees / Board of Directors...and morePension Funds DatabaseOutreach-ready file of 900+ decision-makers across 250+ pension institutions managing $6 trillion in AUM.Database Contact Details Include:• 2,800+ Verified Emails

• 1,100+ Phone Numbers

• 61,720 data points across 30+ fieldsDecision-Maker Titles Include:• Chief Investment Officers

• Portfolio Managers

• Investment Managers

• Fund Managers

• Chief Financial Officers

• Investment Board Members...and other allocatorsESG / Impact Investor DatabaseMapped dataset of 18,000+ verified ESG and Impact investment contacts across 6,500+ firms globally.Investor Types Include:• ESG/Impact-Centric VC Firms

• PE Firms

• Family Offices / HNWIs

• Angel Investors

• Other institutional allocatorsDatabase Contact Details Include:• 18,000+ Contacts

• 17,000+ Emails

• 4,500+ Phone Numbers

• 16,000+ LinkedIn Profiles

• 295,135+ structured data points

• 52% US / 48% InternationalDecision-Maker Titles Include:• Partners

• Portfolio Managers

• CEOs

• CFOs

• CIOs

• Managing Directors

• Managing Partners

• Principals

March 2025 Updates

Key Data Infusions for March 2025:

Fund of Funds Records (Newly Added Data)Contains over 1,000+ decision-makers from:• Funds of Hedge Funds

• Funds of Private Equity Funds

• Funds of Mutual Funds

• Funds of REIT Funds

• Funds of Venture Capital FundsDatabase Highlights:• Created and validated in February 2025

• 50% U.S. / 50% International CoverageKey Database Details:• FoF Description / FoF Investing Thesis

• Individual FoF and Corporate FoF LinkedIn Addresses

• FoF Contact Phone Numbers & Validated Email AddressesReal Estate Investor Records (REI MAX) (Newly Added Data)The Real Estate Investor MAX (REI MAX) database contains 7,000+ contact records from 4,000+ REI entities: commercial, residential, industrial, REITs and more...Key REI MAX Features Include:• All data freshly acquired and validated in March 2024.• Features 6,000+ freshly validated business emails, 12,000+ corporate/personal LinkedIn profiles, and 4,000+ phone numbers.• Provides broad location coverage with street addresses, cities, states, and countries for targeted geographic prospecting.• Emphasizes key decision-maker identification, including CIOs, Managing Partners, Founders, Portfolio Managers, and Investment Directors.• Covers a wide range of real estate investing entities: Family Offices, Institutional Investors, Fund-of-Funds, Private Equity Firms, and other real estate investing firms.Mutual Fund Records (Newly Added Data)This list contains an exceptionally diverse array of mutual fund executives, including chief investment officers, strategists, advisors, and mutual fund managers.Core Features:• Built from the ground up in February 2025• 10X larger than our free LinkedIn giveaway• 2,000+ Verified Contact Records spanning U.S. (60%) and International (40%) marketsDatabase Contact Details Include:• 2,000+ Records covering Names, Titles, and Company/Firm Affiliations• 1,800+ Validated Professional Emails & 700+ Corporate Phone Numbers• 3,900+ LinkedIn Profile URLs for direct networking• Granular Firm Headquarters and Office Locations (Street Address, City, State, Country)Single Family Office Database (Newly Added Data)A comprehensive database of 3,300+ Single Family Office contact records, covering 2,000+ unique Single Family Offices.Coverage Breakdown:• 53% U.S. / 47% International Coverage• 3,000+ Validated Emails: Includes primary and secondary addresses (up to 2 per contact), tested for deliverability.• 1,000+ Phone Numbers: Corporate and Direct Lines (up to 2 per contact).• 2,500+ LinkedIn Profiles: Corporate and individual URLs.Granular Filters Enable Sorting By:• Investment Sectors (Public & Private Equities, Real Estate, ESG, Technology, etc.)• Location Specifics (Street Address, City, State, Country)• Personnel (From Operational Staff to Key Decision-Makers)• Granular FO Intelligence: 89,411 Data Points across 37 Fields of CoverageDecision-Maker Titles Include:• Chief Investment Officers

• Directors of Investments

• Chief Financial Officers

• Family Office Directors

• Managing Partners

• Executive Directors

• Portfolio Managers…and more.Database Composition:Approximately 80-85% of this database contains Single Family Offices. The remaining 15%-20% of the database contain multi-family offices, virtual family offices, family business conglomerates, and entities with close ties to Family Offices.Asian Family Office Database Enhanced (Newly Added Data)Added 3,000+ verified Family Office contact records from 1,500+ unique entities across Asia.Database Contact Details Include:• 900+ Validated Professional Emails

• 300+ Corporate Phone NumbersEuropean Family Office Database Enhanced (Newly Added Data)Integrated 3,300+ verified Family Office contact records from 2,000+ unique entities across Europe.Database Contact Details Include:• 2,000+ Validated Professional Emails

• 700+ Corporate Phone NumbersStartup Founder Database Enhanced (Newly Added Data)Built with 140,000+ verified contacts from recently funded startups.Database Contact Details Include:• 140,000+ Emails & 120,000+ Phone Numbers

• 140,000+ LinkedIn Profile URLs

• 4 Million Data Points across 30+ Key FieldsKey Startup Founder Data Fields Cover:• Name, Title, Company

• Email & Phone Number

• LinkedIn URLs (Personal & Company)

• Industry & Keywords

• Funding Data (Total Funding, Latest Round & Amount)

• Company Size, Location & Website

• Technologies & Annual Revenue

December 2024 Updates

Fresh Investor / Limited Partner DataHere is a summary of FRESH DATA updates that we completed in December 2024:• 16,000 NEW Family Office Records (US, European, Asian)

• 41,000+ NEW Validated Investor & LP Contacts / Emails

• 8,000+ NEW Private Equity Records

• 109,000+ NEW Venture Capital Records

• 6,000 NEW Institutional Investors

September 2024 Updates

Exhaustive Institutional Investor Database with Validated E-Mail AddressesOver 51 Trillion Dollars in AUM.Exhaustive Institutional Investor Database (EIID)EIID data was compiled by our team from scratch.This is entirely New/Unique data for August 2024- none of this LP/Investor intelligence is recycled, shuffled, or repurposed.We have never offered this product before.The culmination of over two years of work.This is the largest and most comprehensive instant download Institutional Investor / LP database available in the world.If you've received our previous Institutional Investor / LP list from Linkedin, you'll find this upgrade to be light-years more valuable in terms of scale, scope, coverage, and correspondence options.Here is how EIID stacks up against our previous version:• 10X Larger: Over 6,714+ Discrete Records with 108,596 data points.

• Includes All Phone Numbers (Primary & Secondary): 3,145+ Phone Numbers

• Includes All Validated/Scored E-Mail Addresses (Primary & Secondary) : 3,587+ Email Addresses

• Includes All Linkedin Addresses (Corporate + Individual): 3,421+ Linkedin Addresses

• 11X more Description / Investing Thesis Data

• Top 1500 Largest AUM LP/Investor Quick Reference Designations

• Significant Pension Fund (27X upgrade) and Endowment Data (9X upgrade) Intelligence Enhancement

• 2X Data Granularity Upgrade

• Expanded Decision Maker Scope/Titles

• 2X Number of Key Personnel Per RecordEIID Focus:Approximately 75% of EIID is U.S. based while 25% is international.The EIID database is comprised of:• Largest Pension Funds / Retirement Funds

• Largest University Endowments

• Largest Asset Management and Wealth Management Firms

• Largest Commercial Banks

• Largest Insurance Companies

• Mutual Funds

• Investment Banks

• Hedge Funds

• Sovereign Wealth Funds (SWFs)

• Real Estate Investment Trusts (REITs)

• Exchange Traded Funds (ETFs)

• Foundation TrustsHere are the key personnel you will find within the database:• Chief Executive Officer (CEO)

• Chief Investment Officer (CIO)

• Portfolio Manager

• Investment Director / Director of Investments

• Endowment Fund Manager

• Chief Financial Officer (CFO)

• Chief Risk Officer

• President

• Head of Risk Management

• Founder

• Partner

• Founding Partner

• General Partner

• Portfolio Director

• Wealth Manager

• Asset Manager

• Fund Manager

• Investment Manager

• Chairman

• Senior Investment Manager

• Director of Private Equity

• Managing Partner

• Head of Asset Management

• Chief Strategy Officer

• Head of Alternative Investments

• Head of Fixed Income

• Head of Equities

• Chief Operating Officer (COO)

• Operations Manager

• Fund Supervisor

• Fund Administrator

• Fund Controller

• Investment Committee Chair

• Investment Committee

• Chief Investment Strategy Officer

• Board of Trustees

• Board of Directors

• Chancellor

• University PresidentEIID Highlights:• Heavy Emphasis on Identifying the Optimal Institutional Investor / LP Decision Makers

• Exceptionally Broad Coverage of All Institutional Investor / LP Flavors

• Multiple Communication/Relationship Building Channels (Phone, E-Mail, Linkedin, other Social)

• Instant Download of the Entire Database

• Detailed Investor / LP Descriptions & Investing Theses

• More Key Personnel Intel per LP / InvestorHere are database samples to download / peruse:3 EIID SAMPLE FILESAnd here is a screenshot of a very small portion of the database:

August 2024 Updates

Private Equity Database Remastered8,000+ PE Fund and PE Fund Decision Makers Uncovered:• Managing Partners

• Managing Directors

• General Partners

• Vice Presidents

• Investment Managers

• Founding Partners

• Principals

• CFOs

• COOs

• Investment Directors

• Investment Committee Members

• CIOsPrivate Equity Database Key Details:• All data freshly obtained in 2024

• Multiple decision makers per PE firm

• Enhanced contact options with up to three phone numbers and emails per record

• Detailed firm descriptions and investment theses

• Expanded outreach channels (email, phone, and Linkedin contacts)

• Special emphasis on uncovering intel from the largest PE firms

• 65% of the Private Equity Database is U.S.A based while 35% is InternationalHere is sample data from the new PE database:Private Equity Data SamplesHere is a screen capture of a small portion of the PE database:

June 2024 Updates

Our Family Office MAX Database Upgrade

Now The Largest and Most Accurate INSTANT Download Family Office Database in the World with 16,000+ Records

FO MAX with Validated E-Mail Addresses, Phone Numbers, and Linkedin AddressesWe've built the first exhaustive A.I. driven 2024 database of both United States (approximately 60%) and International (approximately 40%) based Family Offices.Our tactic and intention in creating this database was shock and awe (capturing the MAXIMUM number of Family Offices) alongside precision (the HIGHEST LEVEL of DETAIL per record).FO MAX Contains:• 1 Excel File• 16,000+ Total FO Records/Contacts• 30+ Columns of Granular FO intel--> Single Family Offices (SFOs)

--> Family Business Conglomerates (FBC)

--> Multi-Family Offices (MFOs)

--> Private Wealth Management Entities (PWME)

--> Virtual Family Offices (VFOs)

--> Embedded Family Offices (EFOs)

--> External FO Service Providers (Attorneys, Banks, Accountants that are Linked to FOs)

--> FO Support / External Connectors• 141,664 Discrete Cells of FO Intelligence• All 2024 A.I. captured records include VALIDATED EMAIL ADDRESSES (approximately 3,240+ validated email addressesFO MAX Data Quality: The A.I. "gets it right" a significant amount of the time, but there are also incidents of misses or "hiccups." Overall our aim was to get 80%+ accuracy levels in aggregate. If you are looking for 100% data accuracy, do not purchase this product.Remember, a substantial portion of Family Offices are hidden, which makes the task of compiling this data particularly challenging.Sample FO MAX DataEmail & CRM Ready Investor Database (ERID)This single excel file database contains ALL of our available investor e-mail addresses (41,000+ E-Mail Addresses)ERID is a compilation of 41,000+ investors/funds/founder emails, all of which have undergone EMAIL VALIDATION TESTING by us in May 2024.ERID Contains:• 1 Primary Excel FileThe database includes these types of records:• Angel Investor E-Mail Addresses

• Family Offices / LPs E-Mail Addresses

• HNWIs E-Mail Addresses

• Funds (VC, PE, Mutual, Hedge) E-Mail Addresses

• Founders / Startups E-Mail Addresses

• Accelerators / Incubators / Venture Studios E-Mail AddressesThe details of each record include:• Investor Name

• Investor Type

• Thesis / Fund Description

• Contact Role

• Investor Phone

• E-Mail Address Risk Profile / Disposition

• Investor LocationSample ERID Data

April 2024 Updates

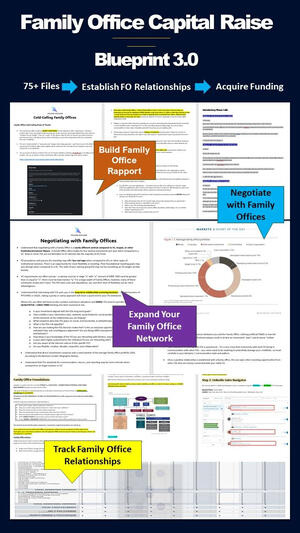

• ADDED Consolidated Venture Capital File (100,000+ Records)• ADDED Version 3.0 of the Family Office Capital Raise Blueprint

March 2024 Updates

• Added 21,000 Diversified Venture Capital Fund Compilation• Added 18,000 Funded Startups with Linkedin & Twitter Contacts• Added 2,751 Nordic Investor Database• Added 1,190 Brazilian Investors• Added 13,000 Angel Investor Compilation

February 2024 Updates

Completely Re-Engineered Private Equity Fund Database 3.0:• Total Private Equity Records Count Now = 8,000+ Records• Consolidated smaller PE Excel lists into a unified database for sorting and lookup by 15+ different categories such as investor category, founding year, and industry preference.• Implemented Excel header dropdown menu, allowing users to sort alphabetically (A to Z or Z to A), code and filter by color, and customize filtering options for fill or text, among other functionalities to optimize data navigation.• Cleaned up columns of existing databases and aligned them with the columns of the new lists to promote efficiency and integrity for more accurate analysis and decision-making.• Added a Readme Excel sub sheet to provide an overview of the PE database and offer guidance on navigating and interacting with its features.• Validated PE Database E-Mail formats to increase overall deliverability (individual e-mails should still be validated before reaching out).• Executed URL validation using a Python script to identify working websites.• Implemented an Embedded PE Contact CRM with dropdown menus:• Included PE dropdown options for status, interaction stage, priority level, investment, and thesis match.• Incorporated PE date tracking functionality within the CRM for accurate timeline documentation.• Easy inputting of PE notes for each contact• Ability to assign team members to specific PE leads.Additional February Master List 360 Data Inclusions:• Added 1,050+ Stealth Startup Database Records• Added 600+ Startup Advisor Database Records• Added 360+ Technology Partnership Leaders Records• Added 1,000+ Angel Investors with E-Mail Records• Added 38,000+ Additional Fund/Finance Contacts (Founders, GPs, VPs, CFOs, MDs) with E-Mail Records• Added Startup Investor Scorecard 3.0 (Internally Created) + Startup Investor Scorecard Ver. 2.0 (External)• Added 1,100+ Angels + VCs in the Pacific North West U.S.• Added 2,000+ Angels + VCs from Sweden, Holland, Croatia, Turkey• Added 2,650+ VCs + Angels from the Unites States (with E-Mails)• Added 5,000+ Top VCs (Seed Stage)• Added 4,900+ DACH Investors• Added 7,500+ English + Irish Investors

January 2024 Updates

• NEW 2,000+ VC Contacts from New York (Phone+E-Mail)• NEW 600+ U.S. Hedge Fund Contacts (Phone+E-Mail)• NEW DACH (Germany, Austria, Switzerland) Investor List• NEW DACH Angel Investors

• NEW DACH Family Offices

• NEW DACH Venture Capitalists

• NEW DACH Grants• NEW 3,500+ Granular Detailed Funded Startup List• NEW 80+ Pre-Seed VCs and Angels• NEW 600 European Investors (Thesis, Preferred Series)

December 2023 Updates

• 27,151 New Venture Capital Records / Contacts• 341 New U.S. State-by-State Family Office Records / Contacts--> NEW NY Based Family Offices

--> NEW Massachusetts Based Family Offices

--> NEW Illinois Based Family Offices

--> NEW California Based Family Offices

--> NEW Florida Based Family Offices

--> NEW Texas Based Family Offices• 209 New European Family Office Records / Contacts--> NEW German Family Offices

--> NEW Swiss Family Offices

--> NEW London Family Offices• 219 New Asian Pacific (APAC) Family Office Records / Contacts--> NEW Australian Based Family Offices

--> NEW Singapore Based Family Offices

--> NEW Chinese Based Family Offices

--> NEW Hong Kong Based Family Offices• 8,294 New Mutual Fund Records / Contacts• 3,683 Latin American Investors / LATAM Funds• 135 New Angel Investors• 490 Startups in Singapore• 1,501 Early Stage SaaS Startups• Hong Kong Venture Capital List• Japanese Venture Capital List• Baltics Venture Capital List• European Technology-Centric Venture Capital List• 1,318 HealthCare Venture Capital List• 1,290 Recently Funded Startups• 1,507 Additional Corporate Venture Capital Records• 2,501 Additional Startup Accelerators• 437 Additional Family Office Founders• 4,100+ Additional European Venture Capital Records• 6,500+ New Global Venture Capital Funds/Contacts• 1,500+ New Private Equity Funds/Contacts• 2,350+ New Family Office Investors / LPs• 900+ New U.S. Venture Capital Records• 1,000+ New Funded Startups/Founder Records• 330+ Pension, Endowments, Family Office Investors• 1,000+ Climate Tech VCs• 1,340+ New Angel Groups and Angel Investors• 500+ Most Active Corporate VCs• 1,000+ VCs that Focus on SaaS Startups

and Even More Master List 360 Highlights...

• 2,700+ Mutual & Hedge Fund Contacts• 23,000+ Angel and Early Stage VC Investors• 400+ Crypto Fund Investors• 4,100+ Institutional Investors (Endowments, FOs, Pension Funds)• 75,000+ email contactsThat’s now over 500,270+ Investors, LPs, FOs, Hedge Funds, HNWIs, Mutual Funds, Startup Founders, Endowments, Angel Investors, Private Equity Funds, Accelerators, VC Studios, and Incubators.One of the most popular components of the Master List Library 360 is our Premium Global Family Office Investor Database:Our Premium Global Family Office Database (17,115+ FO Records):–> Updated in 2024 to include 7,000+ additional Global Family Office Records (US + International)–> Total Number of Global Family Office Records in Our Database is now 17,115+–> Now Officially the largest Family Office Dataset in the WorldFourth Quarter 2023 Family Office Data Inclusion Updates:2,035+ NEW U.S. Based FO Records, including:• 300+ NEW California FOs• 35+ NEW Connecticut FOs• 400+ NEW New York FOs• 100+ NEW Texas FOs• 95+ NEW Pennsylvania FOs• 30 NEW Ohio FOs• 30+ NEW New Jersey FOs• 35+ NEW North Carolina FOs• 130+ NEW Massachusetts FOs• 70+ NEW Canadian FOs• 25+ NEW GULF Region FOsOur Premium Venture Capital Database is also one of the more well-received aspects of Master List 360:Our VC database now has over 107,200+ discrete records.What distinguishes this VC dataset from others is the level of granularity.Both the U.S. VC dataset and the European VC dataset contain our highest level of detail, which means records can easily be filtered so you can laser-target the exact type of investor you are looking for.

and with Master List 360 you also receive...

The Ultimate Capital Raising Blueprint

Learn how to EFFICIENTLY Raise Capital from:-> Family Offices

-> Angels / HNWIs

-> Venture Capitalists• Raise Capital 3-5X Faster• Reverse Negotiating Polarity & Secure Optimal Deal Terms• Identify Your Ideal Investors that are worth Forging Long-Term Relationships with• Create Viral Buzz & Authentic Demand: Let Investors Come to You• Leverage BATNA and Social Positioning to Maximize Your Investment Options• Position Yourself Best to Receive Multiple Term Sheets• Attract Those Investors That Most Closely Align with Your Vision & Values• Get All Your Collateral "Ducks" in a Row (Data Room, Investing Agreements, Valuation, Projections)• Learn to Acquire Funding from Angels, VCs, & Family Offices• Utilize a Hybrid Inbound (Attraction) / Outbound (E-Mail, Phone, & DM) Capital Raise ApproachThe Ultimate Capital Raising Blueprint (TUCRB) Contents:<Raise Capital From Family Offices Guide>Successfully raising capital through Family Offices is undoubtedly challenging.To fulfill funding goals, one must operate through the collaborative lens of congruence, reciprocity, and alignment.Family Office executives are experienced. They can sniff out inconsistencies.Having a systematized and strategic fundraising gameplan is essential in creating uniform positioning and fostering trust.Here's what's included in the FO Capital Raise portion of the TUCRB:• Intel from over 115+ Capital Raisers whose sole focus is on fundraising from Family Offices• Learn how to rapidly expand your network of Family Office Contacts on Linkedin• Learn how maximize the value of Warm Introductions (even without a large network)• The most successful Family Office Cold E-Mail Tactics & Strategies• The most successful Family Office Linkedin Connection & DM messaging• The most successful Family Office Twitter Connection & DM messaging• How to navigate and master the Family Office Negotiation Ecosystem• How to optimize your chances of getting funded using our Family Office Investor Database• How to successfully Cold-Call Family Offices with no pre-existing relationship• Family Office Cold-Call Scripts• Family Office Pre-Call Checklists• Learn How Congruent Positioning can be used to Secure a Family Office Investor...and much more...<Secure Funding Through Venture Capital>• Learn how to maximize every ounce of your leverage when negotiating with VCs• Weigh the full gamut of deal "terms" intelligently; beyond just valuation and dilution considerations• Learn how VCs are going to likely value your company in the 1st Quarter of 2024• Learn the (3) factors that you absolutely must have in order to maximize your negotiating position• Learn how to self-assess and rank different silos of Investability• Learn the critical metrics to calculate before speaking to any VC• Learn how to effectively cold-email and utilize Linkedin to connect with VCs• Learn how to use Twitter to attract an almost unlimited supply of VCs• 15+ sample VC cold-email templates• Learn how to maximize your current network's Investability potential...and much more...<Secure Funding Through Angel Investors & HNWIs>• Laser-target swaths of Angels & HNWIs that are Most Relevant for your funding goals• Identify the Angels & HNWIs that have the highest likelihood of responding to your pitch• Learn what terms and conditions you Should include in an Angel Term Sheet• Learn how to prepare a Realistic Valuation to present to Angels and HNWIs• 10+ Sample Angel cold email templates• Learn How to utilize Linkedin Sales Navigator to laser-target specific Angel subsets...and much more...<Data Room, Supporting Collateral, Investor Agreements, Calculators, & Financial Models>• Term Sheets

• Cap Tables

• Convertible Notes

• Comprehensive Data Room Checklist

• Financial Models

• Pre-Vs-Post Money Valuation Calculator

• Sample Investment Memo

• 3 Statement Financial Models

• Safe Agreements

• Complete Fundraising Checklist 3.0

• TAM/SAM/SOM Calculation Toolkit

• Access to 2000+ Pitch Decks

• Pitch Deck Cold Email Checklist

• Pitch Deck Fundamentals & Advanced Creation Tactics

• Executive Summary Blueprint

• Editable Private Placement MemorandumThe Ultimate Capital Raising Blueprint is the first truly comprehensive fundraising guide that focuses on:• Long-Term Relationship Building/Nurturing Strategies• Win/Win (Non-Gimmicky) Negotiating Tactics• Distinct Capital Raising Methodologies for Each of the Three Investing Categories (FOs vs Angels vs VCs)

and with Master List 360 you also receive...

The Deal Flow Velocity Suite

This Deal Flow Velocity Suite is designed to help maximize your EXPOSURE to investment opportunities.It will help:• Experienced Startup Investors (Angels, VCs, Emerging Managers, GPs, HNWI Wealth Managers, M&A Pros, Investment Bankers, PE Fund Managers, & Finance Pros) who want to broaden access, amplify startup/investment deal flow velocity, and enhance deal flow quality.• Those New to the Startup Investing World (Non-Accredited Investors and Founders) who want a well-defined trajectory and comprehensive foundation of tools to fast-track their entry into the investing world.But let's first take a step back to make sure we have a few concepts down pat...What exactly is Deal Flow?Deal Flow or Deal Sourcing is a term used by investors to describe the rate in which business proposals and investment pitches are being received. Deal flow is the foundational life-blood of every investor. Deal flow velocity impacts the range and volume of potential deals while deal flow sources often determine the quality of investment opportunities that an investor is exposed to.What exactly is Deal Screening?Deal Screening is the processes of evaluating a potential investment fit with a given investor or investment fund.We use deal screening to FILTER OUT investments that are not aligned with our investing goals/preferences.A simple deal screening criteria might be:• Philosophical / Investment Thesis Fit (does the startup fit snuggly into the category that we are looking to invest in?)• Industry / Sector Preferred (does the startup fall outside of our industry/sector preference?)• Investment Stage (Is the startup CURRENTLY in a preferred investment stage- idea, series A, B,C, D, etc.?)• Location (are there specific areas of the country/world that we are most comfortable investing in?)• Lead Investor Quality (Sequoia vs an Inexperienced Angel Investor)• Deal Source / Quality (where did this startup introduction come from- trusted partner, cold outreach, web-based content?)What exactly is Due Diligence?Due Diligence is defined as an investigation of a potential investment to VERIFY critical facts. These facts can include such items as financial records, past company performance, plus anything else deemed material. It follows that due diligence can often be both a time and labor intensive process.Integrating the first three stages of our deal flow together [Sourcing + Screening + Due Diligence], we can now visualize how a typical investment process might unfold, from initial sourcing stages all the way to an exit...What are the best sources and methods to establish a robust/quality deal flow ecosystem?• [bilateral] Professional & Extended Network (associates, co-investors, Linkedin connections & followers)• [inbound] Industry Expertise Content Creation (Linkedin, website, insights, whitepapers, tools, access)• [bilateraI] Investment Bankers / Attorneys / Entrepreneurs / Consultants / Accountants• [inbound] Newsletters (Beehiiv, SubStack, ConvertKit)• [bilateral] Angel Groups / Accelerators / Incubators / Startup Competitions• [outbound] Startup Platforms (Harmonic, Gust, AngelList, MicroVentures, StartEngine, OpenVC, Republic)• [outbound] Data Aggregators (CrunchBase, DealRoom, PitchBook)Here's everything included in the Deal Flow Velocity Suite:• Complete Angel & Non-Accredited Investor Starter Bundle• Deal Screening Optimization Bundle• Amplified Deal Flow / Deal Sourcing Velocity Bundle• Deal Screening Optimization Bundle• Due Diligence / Deal Evaluation Bundle• Amplifying Deal Flow Through Linkedin Bundle• Done-For-You Targeted Startup/Founder Data Bundle (50,000+ Instant Download Records)• Do-It-Yourself Database of 120+ Deal Sourcing Platforms (Access over 250,000 Potential Startup Investments)• Optimized Deal Flow Software Recommendations• How to Purchase a SaaS or Micro-SaaS Bundle• Introduction to Family Office Investing• Venture Capital Fundamentals & Fund Deck Bundle• Value Added MRR/ARR Growth Resources For Portfolio Companies

and...

• One-Year FULL UPGRADE ACCESS to ALL Additional Investor, Fund, & Founder Data (every time we add additional records to our 360 database, you’ll have full access)Remember, Master List Library 360 contains the largest Family Office, Angel Investor, and Venture Capital Datasets in the world with over 500,000 discrete records.And you of course also get our:• Entire Private Equity Fund Database (US & Europe)• Institutional Investor Database• Hedge & Mutual Fund Database• Crypto Investor Database• Dataset of 42,000+ Startup Founders & Accelerators

Master List 360 Data Samples & Terms of Service

You can view data samples of Master List 360 here:Sample DataAnd you can review our TOS and FAQs here:TOS & FAQREMEMBER: this database is full INSTANT download access (excel files). There is zero data throttling like other data providers. You receive an instant download of the entire database of 500,000+ Records [300+ Excel Files].

Summing Up: Here's Everything That is Included in the Master List 360 Bundle

• Venture Capital Database - 100,000+ contacts with coverage across early to late-stage investors.• Angel & HNWI Investor Database - 13,000+ angel investors and high-net-worth individuals• Private Equity Database - 8,000+ PE professionals from 3,000+ firms with global coverage• CRM-Ready Email Database - 216,355+ contacts with validated emails formatted for instant CRM import• Real Estate Investor Database - 7,000+ contacts from 4,000+ entities with 6,000+ validated emails• Institutional Investor Database - 7,000+ decision-maker contact records with expanded location data coverage• Single Family Office Database - 3,300+ SFO contacts from 2,000+ unique single family offices• Fund of Funds Database - 1,000+ decision-makers with 50% U.S./50% International coverage• Asian Family Office Database - 3,000+ verified contacts from 1,500+ unique family offices• European Family Office Database - 3,300+ verified contacts from 2,000+ unique family offices• Investment Banking Database - 2,900+ contacts from 1,000+ unique banks with $500B+ Total AUM• Mutual Fund Database - 2,000+ verified contacts with 1,800+ professional emails• Startup Founder Database - 140,000+ verified contacts from recently funded startups with 140,000+ emails• Family Office Master Database - 16,000+ SFO/MFO/Connector contacts with enhanced multi-criteria search filters.• Legacy Database - Extensive library of 300+ legacy Excel files housing 150,000+ investor contacts• 2025's The Ultimate Capital Raising Blueprint (Including Family Office Capital Raise Blueprint 3.0)• 2025's Deal Flow Velocity Suite

Thoroughly examine our excel database samples before purchasing, which can be found here:Sample DataAnd, review our TOS & FAQREMEMBER: this database is full INSTANT download access (Excel files). There is zero data throttling like other data providers. You receive an instant download of the entire database of 500,000+ Records [300+ Excel Files].

344 West 38th Street

NY, NY 10009 | Brian V. Ortiz

https://www.linkedin.com/in/brianvortiz

(133,000+ Followers)

www.FalconScaling.com

646.389.3259

[email protected]